Neuberg Diagnostics partners with MS Dhoni to send the message of health and wellness

AADHAR, UPI, Aarogya Setu & CoWin App has been India’s incredible success towards digitization in financial and healthcare sector: Mr. Himanshu Kapania

Published on August 17, 2021

New Delhi: Mr Himanshu Kapania, Vice Chairman, Grasim & Director Telecom, Aditya Birla Management Corporation Pvt Ltd. & Chair, BBC Working Group on Digital Economy (India) at the BRICS Business Forum, said India aims to develop Digitization of healthcare with an exchange program among BRICS nations to support and implement health monitoring & use of AI in drug development. He further recommended the following areas for promoting cooperation amongst BRICS countries:

- Digital governance.

- Skills and infrastructure

- Best practices among the member countries.

- Promoting new technologies & critical infrastructure issues.

- Smart manufacturing and Digitization of healthcare.

While addressing the session on Leveraging Digital Technologies for Better Governance and Higher Growth, he added, “The world’s largest biometric system AADHAR, the instant payment system UPI, the Aarogya Setu & the CoWin Apps have been India’s incredible success towards digitization in financial and healthcare sector”.

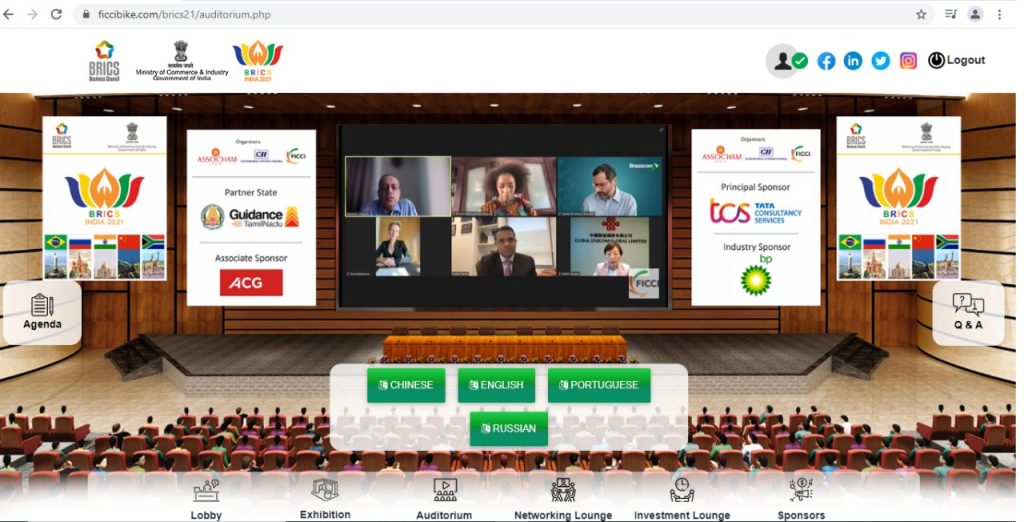

The BRICS Business Forum, one of the key events organised by the BRICS Business Council, offers a platform for members of the BRICS Business Community to discuss and deliberate on key economic cooperation areas and make recommendations on intra-BRICS trade and industry issues.

To further strengthen the trade and economy within the BRICS, the Department of Commerce, Government of India along with FICCI, is organizing the 2nd BRICS Trade Fair which is the largest platform for Indian companies to meet and network with counterpart businesses from Brazil, Russia, China and South Africa. The organizers have informed that 600+ companies from the BRICS Nations will showcase their products and services at the expo and over 15 Investment agencies & States/provinces are showcasing Investment opportunities in their respective regions.

Mr Daniel Stivelberg, Data Protection Officer and Government Relations Manager, BRASSCOM, Association of Information and Communication Technology (ICT) and Digital Technologies Companies (Brazil), said, “We are contributing to the modernization of the country and adding to the enhancement of business while protecting personal data. Digital growth in the year 2020 has been spectacular due to the increase in usage of digital technology, giving rise to the use of AI and internet connectivity. This has led to massive use of E-commerce platforms used by public which enhances business and data thereby creating a mechanism for better governance and enhanced cooperation.”

Ms Anna Nesterova, Chairperson, Global Rus Trade (Russia), said, “Even though the last year has been difficult due to the pandemic, we are looking for the possibility of collaboration with India as we have increased our trade within the country ports. We want to establish collaboration in the highly advanced mining field, particularly high-value metals. The retail sector has increased globally due to the high use of the internet as many people buy online. Digital traffic has increased manifold due to the use of the internet, and we believe our digital economy will be on par across the world.”

Mr Tushar Parikh, TCS Country Head Brazil and BFSI Head Latin America, Tata Consultancy Services (India), said, “Digitization has been most impactful than any other revolution the world has seen in the past. It is empowering people, societies, and nations. India is a diverse society, with 2/3rd of the people living in rural areas with a large young population. The government is trying their best to transform the digital lifecycle through connected ecosystem solutions in areas like education, healthcare, agriculture and more. Ayushman Bharat and other such national initiatives have given a unique identity and regional platform enabling transparency and active participation of the citizens.”

Ms MENG Shusen, Chairman and President, China Unicom Global Ltd. (China), said, “All BRICS nations must expand cooperation & reach a consensus on building a robust digital economy. Digitization of essential services will hugely benefit citizens in each country.”

Ms Phuti Mahanyele-Dabengwa, Chief Executive Officer, Naspers (South Africa) Ltd. (South Africa) BRICS, has been the forefront of the digital revolution. We need to now focus on digitally enabled business platforms which will be the next growth driver as the acceleration of AI is transforming peoples lives and investors. Digital skilling & healthcare connectivity and e-commerce are the top priority of South Africa.”

Session 2: Meeting the Sustainable Development Goals – Role of Financial Sector

Chair and Moderator: Ms Naina Lal Kidwai, Chairperson, Advent Private Equity, India Advisory Board & Chair, BBC Working Group on Financial Services (India), said, “there is a great opportunity to drive investments in various areas of SDGs and BRICS nations can learn tremendously from each other’s experience. India has embraced the SDG targets and is on the way to achieve the climate change goals. India has indeed embraced the target to achieve climate change goals, largely on the renewable energy programme. ESG is the beginning to become the language of the corporate, financial and government financial.”

Mr Guilherme de França Teixeira, Manager of International Affairs, National Confederation of Financial Institutions (CNF) (Brazil), said, “The financial sector assumes the most important role in the private sector because of its ability to provide the chances and the changes that SDG demands. Financial institutions may have a crucial role in fighting poverty and social equality. Affordable and clean energy SDG is highly benefitted from the financing of research and construction of alternative energies. Both academic studies, government research projects and infrastructure investments exemplify how sustainable projects can turn into reality. The idea of responsible governance is growing more each day, both in academia and business area. SDG was created to be the guide for public and private sectors towards a more sustainable future.”

Mr Andrey Kuleshov, Head of Strategy and Development at the Common Fund for Commodities (Amsterdam), Adviser, the Centre for AI Science and Technology at the Moscow Institute of Physics and Technology (Russia), said, “ESG is the official language in Russia, but at the same time SDG is the language of the world not only in business but also in governance and civil society. This has a wider legitimacy and wider reach. The financial sector in SDG framework needs to expand its instruments and strengthen the impact affecting industries and investing firms.”

Mr Amit Chandra, Chairperson, Bain Capital India (India), said, “To achieve the 2030 SDG target, India needs to overcome the hurdles set by the pandemic by acting faster, harder and much more innovatively. The role of overcoming this will be with both central and state governments. Both can drastically improve the quality of social spending by adopting a transparent outcome-output monitoring framework which is importantly aligned to SDGs. This needs to be done for all programmes and schemes and linking public finances to it. Private sectors need to work on much more responsible ESG goals amongst the corporates and investors. Allocate greater share of profit and wealth to innovation to solve biggest problems impacting the planet.”

Mr WANG Kun, Deputy General Manager, International Banking Department, Industrial and Commercial Bank of China Ltd. (ICBC) (China), said, “Commercial banks can play a crucial role in ESG for decarbonizing projects. Looking into the future, more action points have been identified to be implemented like incentive policies, fiscal policies – subsidies, tax reliefs etc., assessing environmental concerns, carbon emissions policies and carbon pricing.”

Ms Fatima Vawda, Managing Director, 27Four Investment Managers (Pty) Ltd (South Africa), said, “It is important to recognize the urgency of the climate change crisis that requires a fast move from disclosure to real-world emission reduction plans. The financial sector might also consider more recent initiatives like the Net Zero Carbon Emissions, underline the need to move beyond disclosure to setting incredible targets in investment portfolios. Aim to manage the available capital to be focused on investment not only for social-economic development but also foster climate-resilient growth.”

Session 3: Priorities for Infrastructure Development in post Covid-19 world

Chair and Moderator: Mr Shailesh Pathak, Head – Special Initiatives, Development Projects, Larsen and Toubro & Co-Chair, BBC Working Group on Infrastructure (India), said,“The recovery in India is delayed; it has not been derailed. All five countries have seen a tremendous impact on infrastructure development’s finance, operation, and design phase. The digital infrastructure in India has seen rise through a mobile payment system and electronic toll collection, and India is optimistic that it will be a digitally-driven economy till the next presidency at BRICS.”

Ms Viviane Saraiva, Chief Administrative and Financial Officer, Construtora Queiroz Galvão (Brazil), said, “Brazil needs investment not only for better infrastructure in connectivity to be competitive but also needs modernization in rail, roads and other forms of transport. While pandemic caused the biggest decline in Brazil’s economic growth, the country has a very significant infrastructure plan via PPIs. Through the Investment partnership programme, the government looks forward to investing in the country and create job opportunities.

Mr Trofim Lakovlev, Head of Division for Analysis and Strategy, Foreign Projects and International Cooperation Department, JSC Russian Railways (Russia), said, “BRICS nations have been cooperating in railway transport including transit, logistics & consulting. 87 % of total freight in Russia and 85 % of passengers move on environment-friendly electric transportation or practically zero emissions.”

Mr Ashutosh Chandwar, COO, Dineshchandra R Agrawal Infracon Pvt Ltd. (India), said, “To make India 5 trillion-dollar economy India needs to reboot its growth and start implementing regional infrastructure pipeline. These sectors cover logistics, transportation, renewable energy, water & sanitation, communication and social infrastructure. A large part of the funding will go to the road sector followed by energy.”

Mr CHEN Zhong, Vice President, China Communications Construction Company Ltd. (China), said, “As the world is going major transition following the COVID 19 pandemic, there is a great opportunity in the infrastructure sector which can boost the economy. The global infrastructure development is slated to grow at 7.4 %, and integration among the functional modules is the key for a boost in this sector.”

Ms Yolisa Kani, Chief Business Development Officer Transnet SOC Ltd (South Africa), said, “There is a need to rethink, reinvent and more importantly involve the private sector for much-needed investments in infrastructure development.”