M3M Foundation embarks on environmental initiative to plant 1 million trees in 3 years

Mudra Yojana Loan Interest Rates for Entrepreneurs

Published on September 17, 2020

Pradhan Mantri Mudra(Micro Units Development and Refinance Agency) Yojana started by the NDA government in the year 2015. Small businesses have immense potential towards contributing to the nation’s GDP. To help MSMEs grow, the Pradhan Mantri Mudra Loan scheme was introduced. The programme focuses on extending financial support to the small business sector and has a variety of sub-schemes designed for specific business needs.

Mudra loan Interest Rate

Mudra loan interest rate is nestled on the guidelines of the PMMY scheme and RBI. The Central bank has fixed the rate to the base rate or MCLR (Marginal Cost of funds based lending rate) for the Commercial Banks to take a loan for the disbursal of Mudra loan to the Micro units. The lending rate prescribed to Regional Rural Banks and Scheduled Cooperative Banks up to 3.5% and not above Mudra refinance rate.

The interest rate charged for Mudra loan depends upon a few factors. They are as follows:

- The individual’s credit history

- Profile of the applicant

- The business requirement of the mudra loan applicant

- Guidelines laid of the scheme and RBI

The rate of interest on loan as per the segments are:

- Shishu Loan-The interest rates range from 1% to 12%

- Kishore Loan-The interest rates range from 8% to 12%

- Tarun Loan-The interest rates range from 11% to 20%

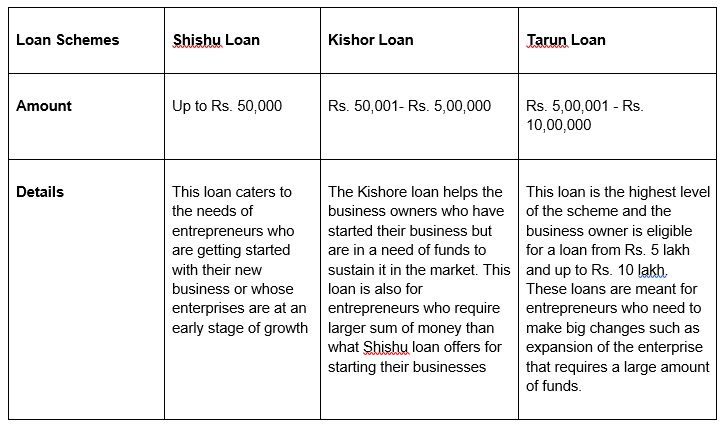

The three loan schemes under Mudra Yojana along with loan amount offered are as follows:

Who can apply for Mudra Yojana?

- Non-farm small enterprise

- Non-corporate small businesses

- Shopkeeper, Small manufacturing unit, Fruit and vegetable vendor and other such small businesses

Pradhan Mantri Mudra Loan Eligibility

- The borrowers should be an Indian citizen.

- The loan requirement should not range more than Rs. 10 lakhs.

- The enterprises generating income from farming activities, cannot apply for MUDRA loan.

- Small enterprises in rural, as well as urban areas, can apply for Pradhan Mantri Mudra Loan.

How to apply Mudra Loan?

- You can apply for a Mudra Yojana with any public or private sector bank and present your business plan.

- Have a detailed plan for the scheme

- You will be required to fill up the application form with your personal and business details

- The application will be quickly processed for existing current accounts. On the other hand, the first time entrepreneur must have an existing open account with the bank for getting a loan soon.

Mudra Card

The Mudra card is a type of credit card, which is issued to the borrower on disbursal of the Mudra loan amount. The Mudra card can be used to purchase raw materials, new machinery, the funds can also be used for working capital where the cash and credit are arranged to the borrowers. The Mudra card has a fixed limit of 20% of the loan amount, subject to a maximum of Rs 10,000. As there are substantial crores of small business units in the country, generating employment opportunities for crores of people. The mudra yojana will help a small business grow and expand; this will also have a positive impact on the GDP of the country. You can use the Finserv MARKETS app to apply for loan in quick and easy steps.