Post-IPO Activity in Gaming Industry Soared by 3,000% in Q4 2020

Published on February 12, 2021

The total investment and M&A in the gaming industry reached $40.57 billion in 2020 across 642 deals.

According to the research data analyzed and published by Safe Betting Sites, the investment activity was concentrated between April 2020 and December 2020, with a $37.89 billion inflow from 406 disclosed transactions. eSports accounted for $1.3 billion of the total.

Based on a Dexerto report, the highest investment in eSports was BITKRAFT Ventures’ $165 million. The VC fund aimed to raise $125 million but surpassed its target.

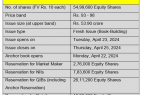

Guild Esports Becomes First eSports Firm on LSE Following $26 Million Listing

M&A transactions in the broader gaming industry were worth $18 billion and accounted for 47.8% of the total value. 20 deals had values above $100 million, four of them crossing the $1 billion threshold. These were Microsoft’s $7.5 billion acquisition of Zenimax, Tencent’s $1.5 billion Leyou acquisition, EA’s acquisition of Codemasters at $1.2 billion and Zynga’s $1.8 billion acquisition of Peak Games.

On the other hand, IPO and post-IPO transaction value in 2020 was $11.35 billion. Q1 was exceptionally slow with only two deals valued at a combined $8.08 million. Q2 and Q3 saw a total of 14 deals valued at $5.48 billion and Q4 got three deals worth $214.4 million.

Guild Esports became the first eSports firm to list on the London Stock Exchange through a $25.85 million IPO. Skillz, an eSports and mobile games company, was first to list under a blank-check company.

While post-IPO activity had plummeted 91% in Q3, it shot up by 2,966% in Q4. The spike was driven by private share issuances and credit facility reorganization by companies that were active in M&A in 2020.

Non-M&A investments in private gaming companies during the year totaled $8.44 billion. They accounted for a 22.3% share of the industry total. The largest was a $1.78 investment into Epic Games.