The Great Indian Teacher Award’ at LEAD Global Conclave 2021

India Exim Bank engages with Indian Pharma companies to promote exports from the country

SBM Bank India Collaborates with OneCard to extend mobile-based credit cards

Published on September 6, 2021

- Card aims to offer a Smart, digital-first experience to the consumers

- Thanks to in-app on-boarding, the virtual card can be activated and used instantly, while the physical card is delivered to the customer in as less as 3-5 days

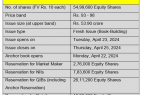

Mumbai : As an extension of the Smart Banking solutions, SBM Bank India, one of the youngest universal Banks has collaborated with OneCard, to introduce a mobile-based credit card. With this partnership, the partner aims to cater to the tech savvy populace who has embraced ‘digital’ as a natural way of life.

Commenting on the partnership, Neeraj Sinha, Head – Retail and Consumer Banking, SBM Bank India, said, “Collaborating with OneCard came naturally to us, given their focus on leveraging technology to create world-class digital products and experiences. This partnership is in sync with our Smart Banking mission to build products that meet specific consumer need gaps and provide innovative solutions through state-of-the-art platforms. The mobile-first, credit card is a significant step towards acknowledging and celebrating the expanding digital ecosystem of the country.”

OneCard is a fintech start-up that aims to digitally revolutionise credit and payments in India. The partnership combines OneCard’s exceptional technology to manage the complete digital credit card lifecycle and SBM Bank India’s banking prowess consisting of its diverse product range, collaborative ecosystem, and global expertise in finances. This partnership will cater to the tech-savvy population offering a mobile-first approach.

On the launch Vibhav Hathi, Co-founder & CMO, OneCard said “Research has shown multiple times that ‘empowerment’ and ‘transparency’ are the two main aspects which the digitally savvy young consumers are seeking today. This corroborates our belief that they are hungry for credit cards which allow them to be in the driver’s seat, giving them full control. It is this desire we are meeting with our digital, flexible, transparent, and personalized cards. We endeavour to re-imagine every aspect involved in credit and payments from first principles while using modern technology.”

The co-branded card is powered by a slick, smart OneCard app which, for the first time ever, gives the customer full control of their credit card – spends, rewards, limits, payments and more, thus evading any form of human intervention. OneCard will leverage Visa’s technology and global acceptance.

The company earlier launched the OneScore app in 2019, to empower people to monitor and manage their credit health in a simple, secure manner; without any spam. The scoring platform is widely popular and has acquired more than 7 million users within just two years of its launch.

According to ResearchAndMarkets, the Indian credit card industry is expected to grow at a CAGR of more than 25% during 2020 – 2025 owing to the growing trend of ‘buy now pay later’. While the number of cards issued between June 2020 and May 2021 is 5.2 million, yet there are only 3 credit cards per 100 people which underlines the high penetration opportunity. With increasing digitisation across categories after the Covid-19 pandemic, the adoption of credit cards has grown even further, however the experience has not evolved. OneCard aims to usher in a digital transformation whilst offering next-gen experience to both existing credit card users and first-timers across the country.

In case of traditional credit cards, besides fulfilling a host of eligibility criteria and documentation, the cards take more than a couple of weeks to reach the customer. However, in case of OneCard, a user can easily apply for the card digitally via the OneCard or OneScore app, thus evading any physical contact with card agents. The in-app card gets activated instantly and is ready for usage immediately, while the physical card gets delivered in as less as 3-4 days.