Hotel investment volume in 2020 witnessed a 60% global decline in comparison to 2019: JLL

Alibaba`s Gross Merchandise Value to Hit $1.2T by 2025, 55% More than Amazon

Published on March 24, 2021

While many Chinese companies have faced severe challenges and losses caused by the COVID-19 pandemic, Alibaba Group emerged as one of the country’s biggest corporate winners in times of crisis. The multinational tech giant expanded its business significantly in 2020, as demand for its services and online marketplace surged amid the lockdown.

According to data presented by AksjeBloggen.com, Alibaba’s gross merchandise value is expected to continue growing in the following years and hit $1.2 trillion by 2025, 55% more than its biggest competitor Amazon.

Alibaba Group’s Revenue Jumped by 35% Amid Pandemic, eCommerce Platforms Hit 780M Users

Alibaba Group emerged as China’s leading eCommerce company after the 2003 SARS outbreak. Since then, it has become a significant hirer and a lender, providing more than 100,000 jobs and offering billions of dollars in loans to SMEs.

One of the group’s most profitable marketplaces is Taobao, responsible for more than 80% of its sales. Unlike Amazon, Alibaba isn’t involved in direct sales and doesn’t own warehouses; it simply helps branded manufacturers and small businesses to reach consumers.

Statistics show that revenues of the Chinese e-commerce corporation surged in recent years. In 2015, Alibaba Group generated $11.7bn in revenue, revealed the company’s earnings reports. This figure soared by 390% to $57.9bn in 2019 and continued rising.

In the fiscal year ending March 31, 2020, Alibaba reported around $72bn in revenue, a 35% increase in a year. Almost 70% of that value was generated through the domestic commerce retail business.

The company`s earnings report also revealed that last year gross merchandise volume jumped by 15% YoY and hit over $1 trillion for the first time. Taobao sales generated almost 50% of that value. On Singles Day 2020 only, online shoppers placed more than 2.3 billion orders on Alibaba’s Tmall and Taobao eCommerce platforms, surpassing US Cyber Monday sales.

The impressive growth of sales and revenues was fuelled by a surge in online shopping in Alibaba’s home market China. Due to less developed physical stores and cheap logistic services, the e-commerce market has grown rapidly in third-and-lower tier cities in recent years. Cross-border online shopping is also becoming a trend, as people are becoming more aware of international brands. Today, China has the largest number of online shoppers globally, almost 783 million in 2020.

The vast majority of them are using one of Alibaba’s eCommerce platforms. Statistics indicate the number of annual active consumers on Alibaba’s online shopping properties in China hit 779 million in December last year, up from 711 million in 2019.

Amazon’s Gross Merchandise Volume to Hit $795B by 2025

The surge in online sales amid pandemic also fuelled Amazon’s sales and revenue growth. The Future Shopper Report 2020 conducted and published by Wunderman Thompson Commerce showed 48% of global online shoppers choose Amazon as their preferred shopping destination for entertainment items.

Additionally, 37% of respondents preferred Amazon as their first shopping destination to buy toys and 29% for tech purchases.

In 2020, sellers on the Amazon marketplace sold $300bn worth of goods, $100bn more than in 2019. The total gross merchandise volume, including sales by Amazon itself and by the marketplace, hit almost $490bn.

Net revenue of the world’s second-largest eCommerce company jumped by 38% year-over-year and hit $386bn in 2020. Retail revenues accounted for 76% of that value.

Amazon`s 2020 annual report showed online stores generated almost $198bn in revenue last year, up from $141.2bn in 2019. Third-party seller revenues also spiked amid the pandemic reaching $80.5bn in 2020, almost a 50% increase in a year. Only psychical store revenues slipped to $16.2bn, compared to $17.2bn in 2019.

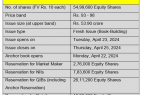

The Edge by Ascential projections for 2025 show Amazon’s gross merchandise volume is set to continue growing in the following years and jump to $795bn, $405bn less than the leading Alibaba Group. Walmart would rank third, with $644bn gross merchandise value.

Pinduoduo and JD.com are forecast to hit $611bn and $462bn in GMV by 2025 and rank fourth and fifth on this list.