Chinglensana Konsham renews for four-years with Hyderabad FC

Retail focused housing finance company, Aptus Value Housing Finance India Limited’s initial public offering of its equity shares (“IPO”) to open on August 10, 2021, sets price band at Rs. 346 – 353 per equity share

Published on August 5, 2021

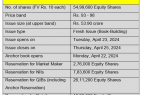

· Price Band of Rs. 346 – Rs. 353 per equity share of face value of Rs. 2 each (“Equity Shares”)

· The Offer consist of Fresh Issue of Equity Shares aggregating up to Rs. 5,000 million and an offer for sale aggregating up to 64,590,695 Equity Shares by certain existing shareholders of the Company (“Selling Shareholders”).

· Bid/Offer Opening Date – Tuesday, August 10, 2021 and Bid/Offer Closing Date – Thursday, August 12, 2021

· Minimum Bid Lot is 42 Equity Shares and in multiples of 42 Equity Shares thereafter

· The Floor Price is 173 times the face value of the Equity Share and the Cap Price is 176.50 times the Face Value of the Equity Share

Risk to Investors: The four BRLMs associated with the Offer have handled 34 public issues in the past three years, out of which 10 issues closed below the issue price on listing date. • Weighted Average Return on Net Worth for Fiscals 2021, 2020 and 2019 is 13.52%. • Average Cost of acquisition of Equity Shares for the Selling Shareholders, namely Padma Anandan, JIH II, LLC, Aravali Investment Holdings, Madison India Opportunities IV, GHIOF Mauritius, KM Mohandass HUF, Saurabh Vijay Bhat and R Umasuthan is ₹8.74, ₹105.62, ₹70.36, ₹70.31, ₹6.50, ₹2.00, ₹6.00 and ₹57.00,, respectively and the Offer Price at the upper end of the Price Band is ₹353 per Equity Share.

Aptus Value Housing Finance India Limited (“Company”), one of the largest housing finance companies in South India in terms of asset under management, as of March 31, 2021 (Source: CRISIL Report) and having the largest branch network in South India among the peer set, as of March 31, 2021 (Source: CRISIL Report), will open its initial public offering of Equity Shares (the “Offer”) on Tuesday, August 10, 2021 and close on Thursday, August 12, 2021. The price band for the Offer is at Rs. 346 – Rs. 353 per Equity Share.

The Offer comprises of a fresh issuance of Equity Shares, aggregating up to Rs.5000 million and an offer for sale of Equity Shares aggregating up to 64,590,695 Equity Shares by the Selling Shareholders.

The Net Proceeds from the Offer will be utilized towards augmenting the Company’s tier 1 capital requirements.

The Company, the Individual Promoter Selling Shareholder and the Investor Selling Shareholders have, in consultation with the book running lead managers to the Offer (the “BRLMs”), considered participation by Anchor Investors, whose participation shall be on Monday, August 9, 2021 i.e., one Working Day prior to the Bid/ Offer Opening Date.

The Offer is being made in terms of Rule 19(2)(b) of the Securities Contracts (Regulation) Rules, 1957, as amended, read with Regulation 31 of the SEBI ICDR Regulations. The Offer is being made in accordance with Regulation 6(1) of the SEBI ICDR Regulations, through the Book Building Process wherein not more than 50% of the Offer shall be available for allocation on a proportionate basis to Qualified Institutional Buyers, not less than 15% of the Offer shall be available for allocation to Non-Institutional Bidders and not less than 35% of the Offer shall be available for allocation to Retail Individual Bidders.

ICICI Securities Limited, Citigroup Global Markets India Private Limited, Edelweiss Financial Services Limited and Kotak Mahindra Capital Company Limited are the BRLMs to the Offer.

All capitalized terms used herein and not specifically defined shall have the same meaning as ascribed to them in the Red Herring Prospectus dated August 2, 2021 read together with the corrigendum to the Red Herring Prospectus – Notice to Investors dated August 4, 2021 (together, the “RHP“) filed with the Registrar of Companies.